Arrangements involving the grant of an option must be processed on Electronic Duties Returns EDR. Stamp duty of 05 on the value of the services loans.

The total amount of ad valorem duties at the first stage reflects the United States tariff increase of 10 and 25 on imports of bumper stampings of aluminium comprising parts and accessories of the motor vehicles of headings 8701 to 8705 and bumper stampings of steel comprising parts and accessories of the motor vehicles of headings 8701 to 8705 both.

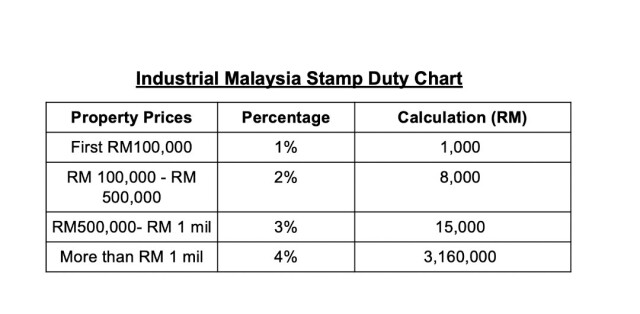

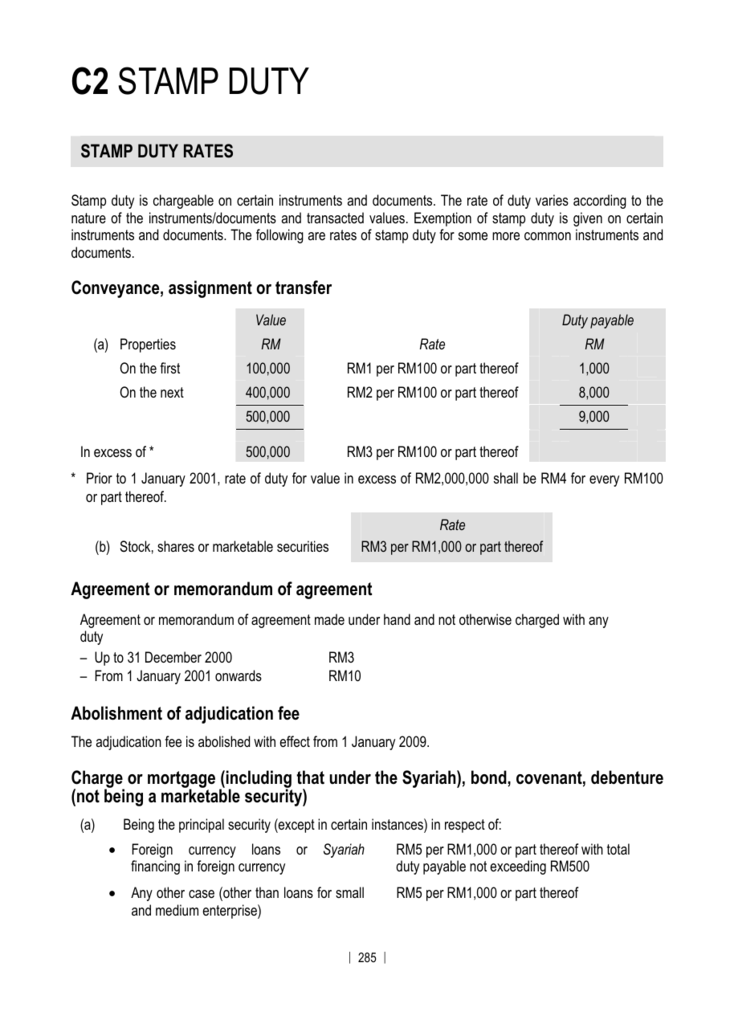

. Ad valorem duty is calculated on the option fee consideration paid for the grant of the option. Ad Valorem Duty The rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or. Ad Valorem Duty is the rate of duty varies according to the nature of the instruments and the consideration stipulated in the instruments or the market value of the property.

0 0 Report Abuse Disclaimer. 2 Amendment Ordinance with effect from 5 November 2016. Ad valorem duty will be payable based on the value of 100000 or consideration paid by A to B if any.

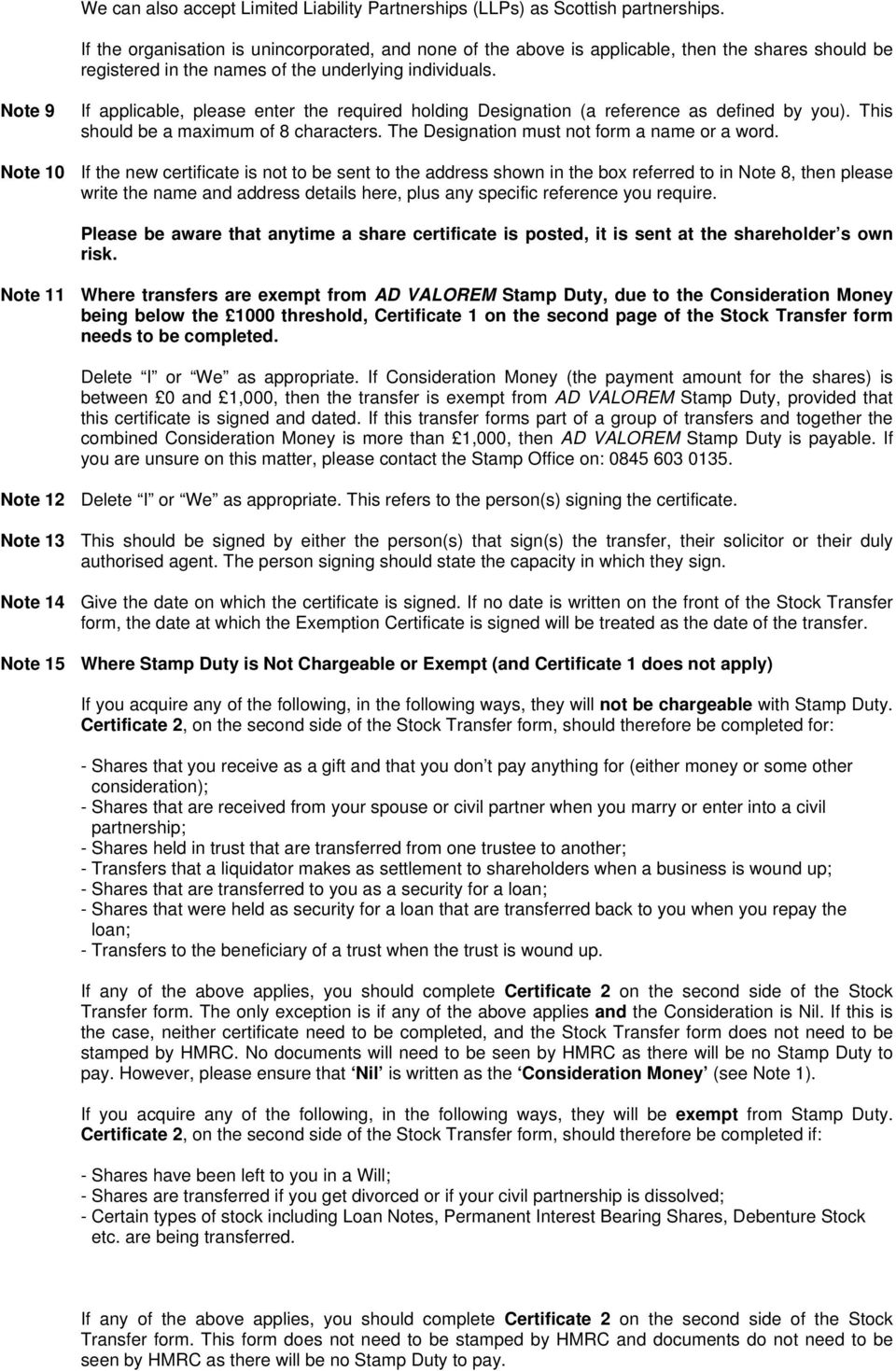

Stamp Duty on a Single Contract for Multiple Properties Where there is a single contract for the purchase of multiple properties followed by individual documents for the purchase of each property the single contract should be stamped at ad valorem duty based on the total purchase price. As of 2020 house purchases below 250000 dont incur any stamp duty. Ad valorem Stamp Duty is levied on the transfer on sale of stock or marketable securities where the amount or value of the consideration paid is in the form of cash debt or other securities.

Stamp duty is not payable when the shares are transmitted by operation of law and automatically vested in the succeeding entity where no consideration was paid and no instrument of transfer was executed. New Stamp Duty processes were introduced on 25 March 2020. Inheritance tax expatriation tax or tariff.

Stamp Duty Assessment This document may be subject to a Stamp Duty Assessment. An ad valorem tax may also be imposed annually as in the case of a real or personal property tax or in connection with another significant event eg. Stamp Duty on Multiple Documents.

Stamp duty on a loan agreement is a flat 05 rate applied to the full value of the loan. Views expressed by the users above are their own Info Edge India Limited does not endorse the same. Pengecualian apa-apa surat cara yang dikenakan duti ad valorem bagi pindah milik hartanah yang digunakan bagi maksud menjalankan suatu projek pelancongan yang layak dikecualikan daripada duti setem.

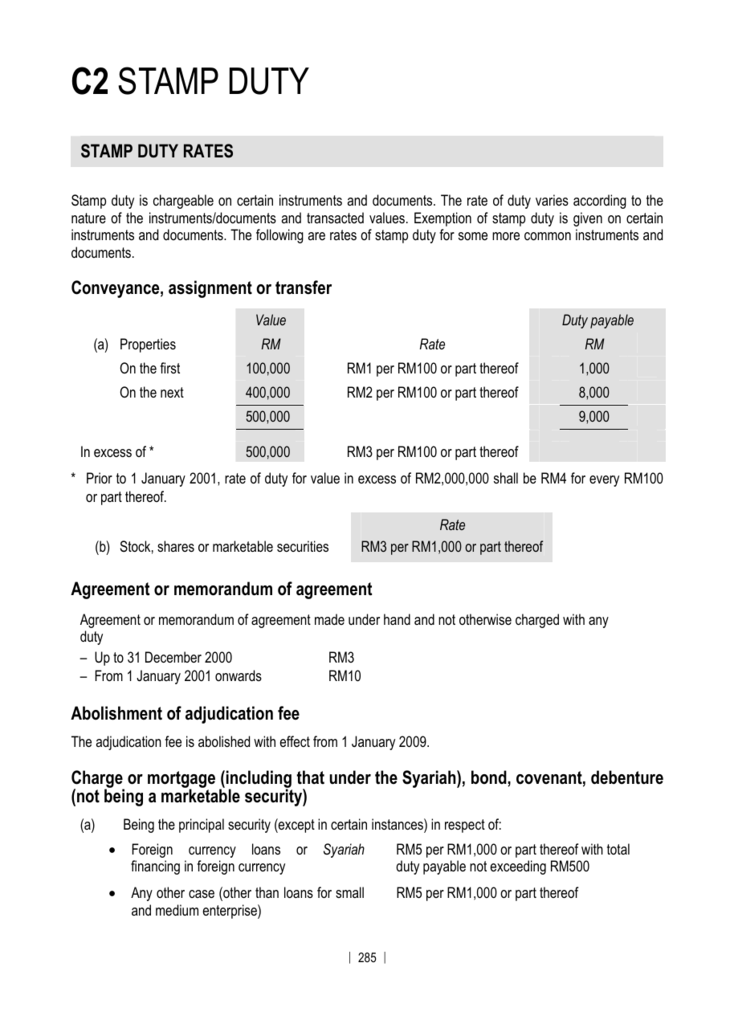

The marginal tax rates on new houses in the UK is. Between 23 Feburary 2013 and 25 Novemeber 2020 AVD charged at Scale 2 is payable on the ASP for acquisition of the residential property if the HKPR is acting on his own behalf in acquiring the property. Under the 2018 Amendment Ordinance AVD at Scale 1 are divided into Part 1 a flat rate of 15 and Part 2 original Scale 1 rates under the 2014 No.

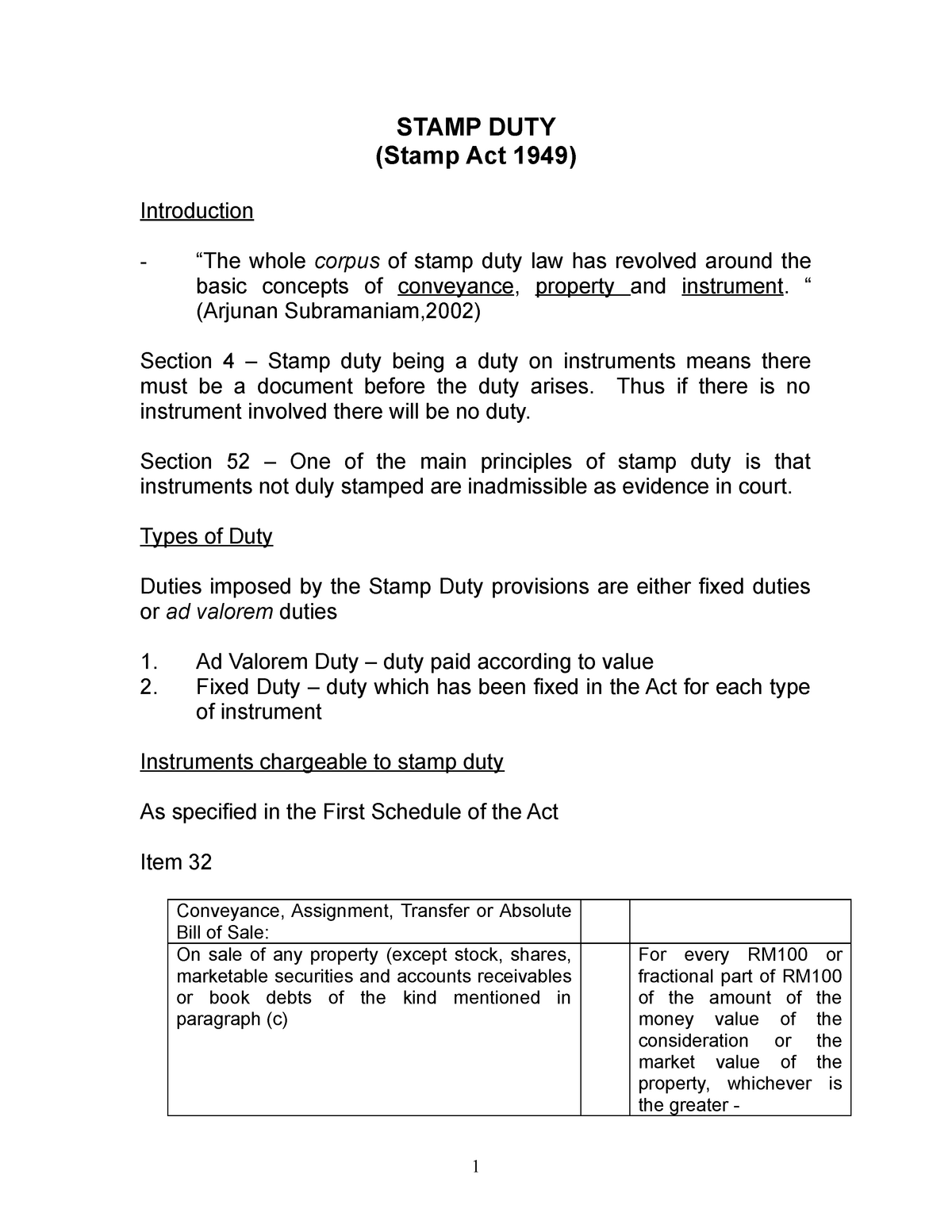

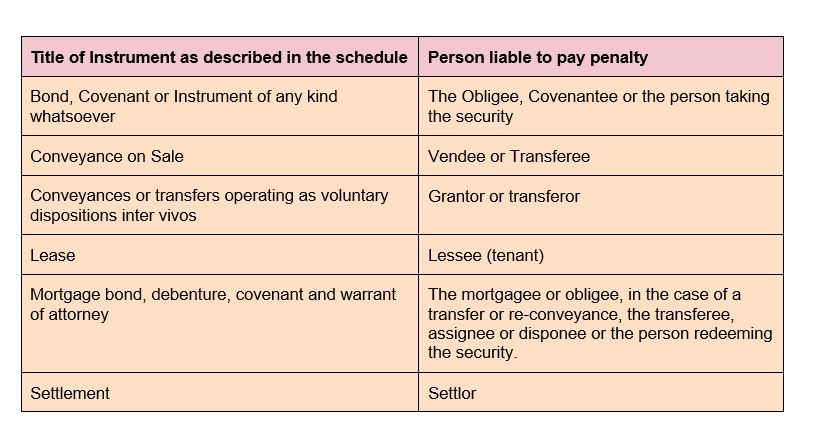

100000 is the excess benefits. There are two types of duty Ad Valorem Duty and Fixed Duty. TYPES OF DUTY 1.

Fixed Duty Duty is imposed without any relation to the consideration paid or amount stated in the instrument. The Stamp Duty Amendment Ordinance 2018 2018 Amendment Ordinance was gazetted on 19 January 2018. In some countries a stamp duty is imposed as an ad valorem tax.

Year 2016 Stamp Duty Order Remittance PUA 365. The Government introduced the DSD in 2013 as one of the measures to rein in soaring property. The option fee includes GST if applicable.

However homebuyers will pay 5 for assets valued between 250001 and 325000 or 10 on purchases between 325001 and 400000. This adds a stamp duty tax of 7500 to a home valued at 350000. 2 tax on purchases between 125000 and 250000 5 tax on purchases from 250000 up to 925000 10 tax on purchases from 925000 to 15m 12 tax on purchases over 15m Stamp duty UK 2.

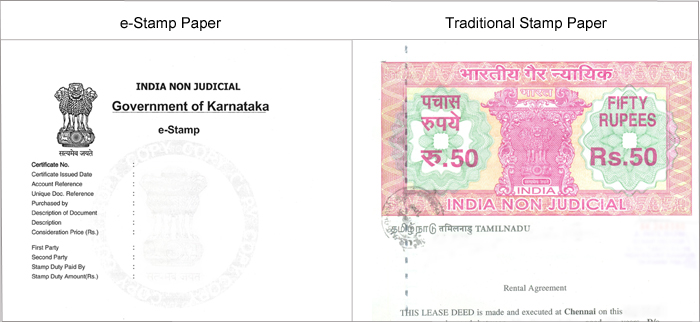

You do not need to. Stamp Duty is payable on any document described as. According to the value of the purchased or transferred land vendors will have to pay an.

The Assessment and Collection of Stamp Duties is sanctioned by statutory law now described as the Stamp Act 1949. AVD at Part 2 of Scale 1 is payable for. Where Stamp Duty is paid on a stock transfer form since then that instrument is duly stamped for all purposes.

The payment of stamp duty on A d-Valorem basis means that it is paid on the basis of the wh at the value of the property i s. According to Adam Smith the tax which each individual is bound to pay ought to be certain and not arbitrary. The Stamp Duties Act specifically provides which transactions and instruments ad valorem duties are payable and it would seem that the FIRS has extended the rates payable on Loan Capital to Loan Agreements.

100 loan is possible but uncommon for most people. The duty on a sale or transfer of land is paid in accordance with the rates published by Revenue NSW. Stamp duty This is an ad valorem tax on buying a new house.

Contents 1 Operation 11 Collection 12 Tax value 2 Examples 21 Land value tax. However stamp duty may be remitted in excess of 01 for the following instruments. So for a property priced at RM500000 you would typically apply for a 90 loan RM450000 as 10 of the property price will be for the down payment which you would need to fork out yourself.

Agreement for Sale Contract for Sale Purchase Agreement Or any other document which has the effect of binding a property owner to sell the property after any conditions of the Contract have been met. Tas surat cara pindah milik harta di bawah Pengecualian di bawah subperenggan 1. Hong Kongs Chief Executive announced in her 2020 Policy Address on 25 November 2020 that the double ad valorem stamp duty DSD imposed on non-residential property transactions will be abolished with effect from today ie 26 November 2020.

The most common example of the calculation of duty on an ad valorem basis is the transfer of land or business duty formerly known as stamp duty in NSW.

Commercial Property Market Stamp Duty Hkwj Tax Law

The Stamp Duty Act 1972 The United Republic Of Tanzania The Stamp Duty Act Studocu

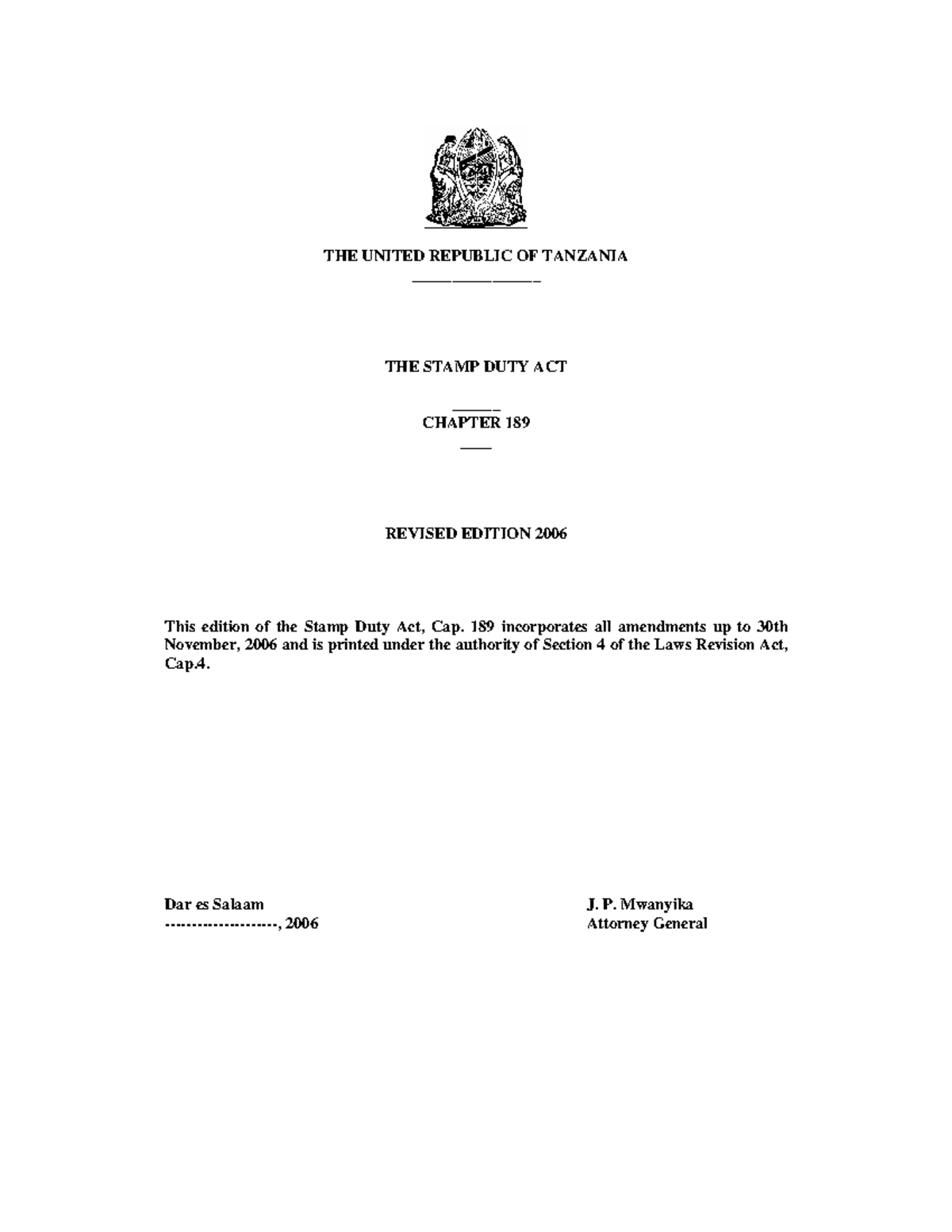

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

Pin On Ephemera Labels Money Stamps Documents And Related Stuff

C2 Stamp Duty The Malaysian Institute Of Certified Public

Legaldesk Com What Is Stamp Duty

W R Grace Co 2020 Annual Report 10 K

Stock Transfer Form Please Ensure All Pages Of This Form Have Been Completed In Block Capitals See Checklist On The Last Page V22 10 Apr Pdf Free Download

News Updates Damian S L Yeo L C Goh

Firs Clarifies Stamp Duty Rates Order Charges On 10 000 Credit Alerts

Stamp Duty Notes Statutory Valuation For Auction Rating Wayleave Easement Stamp Duty Stamp Studocu

How To Build A Townhouse Development Feasibility Case Study

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Stamp Duty Oghogho Makinde Partner Aluko Oyebode Private

Taiwo Oyedele On Twitter Any Other Provision Of The Sda Other Than The Schedule Can Only Be Amended By An Amendment Bill Duly Passed By The National Assembly And Assented To By